Professor François Lévêque during the ENERPO Workshop at the European University at St. Petersburg on October 9th. Source: @EUSP

Professor François Lévêque from Mines-ParisTech led the latest workshop organized by the ENERPO Research Center at the European University at St. Petersburg. Lévêque gave a lecture on natural gas competition in Europe, and highlighted two main issues: firstly, Gazprom is currently experiencing pressure from the entry of new players into the European gas market. This competition, created by the import of Liquefied Natural Gas from the United States (US LNG) into Europe, could eventually result in a possible price war. Secondly, Gazprom is facing an antitrust complaint filed by the European Commission for ‘abuse of its dominant position‘.

Gazprom vs. US LNG competition: a price war?

During the workshop, François Lévêque and the audience debated on whether there might be a price war between Gazprom and US LNG following the opening of competition for gas supply in Europe. Different perspectives were explored as to what Gazprom could expect in this matter, ranging from a relocation of part of its exports to Asia, to a strategy of profit maximizing by defending its existing market share in Europe. As for Lévêque, he admitted that it is difficult to assess with certainty that there will be a price war and, more importantly, who would be the winner. The retail price of gas is higher in Asia, which, from a seller‘s perspective makes it a more interesting market for export both for US LNG and Russian gas. As a matter of fact, it is expected that there will be more and more arbitrage for Europe and Asia in terms of gas supply.

Defending a price strategy or a market share strategy?

However, considering that the production of gas in the European Union (EU) is declining and that the EU has initiated important reforms towards a decarbonized economy, the consumption of gas is likely to increase, which would trigger the need for more imports. [1] As a matter of fact, according to Lévêque, Gazprom should certainly defend their market share to maximize profits. Yet, the company could also force their prices on their customer by lowering the number of supplying contracts. A price strategy remains risky as this could provide incentives from the EU’s end to increase competition, and import more US LNG at a lower price than Russian gas.

At the end of the day, underlined Lévêque, what Gazprom should fear the most is simply the perverse effect of the presence of another player on the market: even though the US would benefit more from selling their LNG on the Asian markets, the mere existence of the possible competition of US LNG imports in Europe can be sufficient to affect Gazprom’s strategy and put a cap on their prices. To resume the case, it is not Gazprom vs. US LNG, but rather Gazprom vs. LNG.

Prospects for the future of gas imports in Europe

Lévêque noted that several scenarios have to be considered regarding the future of gas in Europe by 2025. Firstly, we are likely to be looking at an increase in prices after 2025, especially as the EU fosters a low carbon economy, the result of which will certainly trigger a change in gas demand. Although, it is not clear whether to expect a drop or an increase in gas demand, as it is relayed in a study by the European think tank Bruegel: “Many business-as-usual scenarios foresee increasing gas import demand [in Europe by 2025]; however, all scenarios that implement the requirements of the Paris Climate Agreement lead to a dramatic drop in the demand for natural gas”.[2] , For the professor from Mines-ParisTech, in all cases scenario the future of gas import in Europe is very uncertain after 2025.

In addition to the uncertainty of EU gas demand, Lévêque also pointed to some political concerns that could lead to a drop in imports of Russian gas to Europe. Firstly, the Trump administration is putting high pressure on Russian gas through the current sanctions regime and is causing dissension around the Nord Stream 2 pipeline. The EU Member States themselves are not actually unanimous on that matter either and hurdle around the questions of pipelines and transit. Nevertheless, this is a clear hamper on the ease of using Russian gas and has created a lot of uncertainty as to its stability. On top of that, one should remember that the ‘clean energy package for all Europeans‘ is strongly incentivizing the usage of energy sources such as renewables and electricity. Finally, given the state of the relationship between Russia and the EU at the moment, the unpredictable behavior of EU policymakers is also an issue to be considered. In all those cases, we are again certainly looking at more arbitrage between the EU and the Asian market for Russian gas exports according to Lévêque.

Gazprom vs. the European Commission

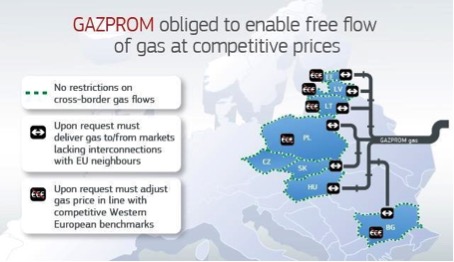

Another concern that Lévêque highlighted is the antitrust case between Gazprom and the European Commission. This lawsuit was filed against Gazprom by the European Commission in 2015 for breaching EU antitrust rules. As per the official statement, the Commission accused Gazprom of ‘pursuing an overall strategy to partition gas markets along national borders in eight Member States‘, and that ‘this strategy may have enabled Gazprom to charge higher gas prices in five of these Member States‘.[3] In May 2018, the Commission then imposed a new set of rules that aim to change the way Gazprom sells gas to Europe, by enabling the free flow of gas in Central and Eastern Europe at competitive prices through:[4]

- No more contractual barriers to the free flow of gas;

- The obligation to facilitate gas flows to and from isolated markets;

- A structured process to ensure competitive gas prices;

- No leveraging of dominance in gas supply.

Although the lawsuit ended up in a settlement with Gazprom in May 2018, one may question the commitments, the possible failures or implementations to be carried out: “Was the case against Gazprom well founded? Was Gazprom’s position on the market an infringement to the EU principles? At the end of the day, is the Commission right or wrong?”, asked Lévêque. To him, it stands proven that there was verifiably unfair and excessive pricing of Russian gas towards the EU Member States, discriminations on the market as well as territorial restrictions, which indeed constitute an infringement of EU antitrust law. Lévêque noted that the case is also a matter of political economy; for the Europeans this is not about competition yet about the good functioning of the internal market.

Infographic on the latest lawsuit between the European Commission and Gazprom. Source: European Commission

There are several pro and cons regarding the current issues of the law case, according to Lévêque. Firstly, if the settlement fails, which would result in a situation of prohibition of Russian gas, there would be a restructuration of the gas market in the EU, especially from Gazprom’s end, in the form of sales of assets and gas releases, which can be considered a pro. However, this could also lead to damages for the private sector and to a long and uncertain process of readjusting to a new market reality, with the main question being where to find the missing gas. If Europe does receive some commitments from Gazprom’s end (which would be the case with a settlement), this would mean an increase of competition (which can be considered a pro), although this competition would essentially be between Gazprom gas and Gazprom gas; they will not be able to monopolize pricing anymore, but would stay the only seller. Nevertheless, Lévêque would consider that to be a win-win situation: it would provide an immediate remedy to an antitrust situation whilst private parties could appeal to the settlement to get damages from litigation. It would also guarantee low prices for Central and East European countries (CEEC), security of supplies for consumers, as well as lower contributions from the Member States. However, it would rather transform the antitrust authorities into regulators, thus changing their function and de facto uncover a failure in the current legislation implementation.

To summarize, the lawsuit provides additional competitive pressure to Gazprom, which is most likely to increase in the future, adding above European gas market remains uncertain for Gazprom due to the openings for LNG in the EU gas market..

François Lévêque is a professor of economics at Mines ParisTech, and a part-time professor at the Robert Schuman Center for Advanced Studies (European University Institute, Florence School of Regulation). His research, teaching and consulting interests are in the areas of antitrust, energy, intellectual property rights and network regulation. François Lévêque is head of the Chair on The Economics of Natural Gas at Mines-ParisTech.

Vanille Dabal Junior Fellow at the ENERPO Research Center and Deputy Editor-in-Chief of the ENERPO Journal. Address for correspondence: vdabal@eu.spb.ru

[1] Although considered counter-intuitive to some, the general expectation is that the transtition to a cleaner energy system will for the foreseeable future be strongly tied to an increased usage of natural gas. This is because, due to short response burn cycle, gas functions as the perfect back-up fuel for non-consistent renewables energy sources (solar, wind, etc.) whilst it also burns up to 60% cleaner than coal or oil.

[2] Zachmann, G., 2018. LNG and Nord Stream 2 in the context of uncertain gas import demand from the EU. Bruegel, 28 September. Available at: http://bruegel.org/2018/09/lng-and-nord-stream-2-in-the-context-of-uncertain-gas-import-demand-from-the-eu/ [Accessed: 20 October, 2018].

[3] European Commission, 2018. Antitrust: Commission imposes binding obligations on Gazprom to enable free flow of gas at competitive prices in Central and Eastern European gas markets. Press release [online]. Available at: http://europa.eu/rapid/press-release_IP-18-3921_en.htm [Accessed: 30 October 2018]

[4] Idem.