By Alexander Geysman

This week’s review, last in the season, takes us almost on every continent with stories about Middle Eastern oil, politics and electricity, Gazprom deals, China’s ambitions, LNG innovation and US problems. Let’s take a look.

Topic 1: Middle East

As usual, the Middle East was the number one topic for our weekly discussion of the world oil and gas affairs. According to Iranian Minister[i] of Petroleum, Bijan Zanganeh, “Most countries want OPEC’s decision to be extended”. In this way, Iran is ready to contribute to a possible extension of the agreement, initially planned for the first half of 2017. “Iran also supports such a decision and would submit to it if the other countries also comply.” OPEC meets on May 25 to consider extending the cuts beyond June. Meanwhile the Minister’s direct chief, Iran’s president, Hassan Rouhani, announced his candidacy in the Iran election that will be held in Iran on 19 May 2017. He faces tough re-election[ii] race as the candidate list closes with a record number of 1,636 people, but the main challenge would be from the 56-year-old Raisi, who can attract conservative voters from Iran’s provinces.[iii]

The head of Saudi Arabia’s state energy giant, Amin Nasser, warned[iv] on Friday that 20m barrels a day in future production capacity was required to meet demand growth and offset natural field declines in the coming years, warning of a looming oil shortage as a $1 trillion USD drop in investments into future production takes effect. As all recent KSA stories are viewed in the context of the coming Saudi Aramco’s IPO[v], this one as well may be viewed as a signal from the kingdom.

A new power plant in Iraq. Jordan based Mass Group Holding (MGH) has partnered[vi] with General Electric to build a mega power plant near Baghdad, which upon completion will add 3,000 MW, taking the total power production of MGH in the country to 7,000 megawatts. Located about 40 km from Baghdad, the facility is the first one in the country outside the Kurdistan region to be developed by an independent power producer on a build-own-operate (BOO) basis for the Iraqi MOE.

TOPIC 2: RUSSIA, GAS AND THE NEIGHBOURS

No week passes without someone chanting the urge to get off the Gazprom “needle “, this one was not an exception.

On April 12, Georgian Energy Minister Kakha Kaladze said[vii] that his country is ready to avoid importing any gas from Russia soon. As of now, Georgia only gets about 10% of its gas from Russia, while the remaining 90% comes from Azerbaijan. This statement contradicts a prior statement released last year, in which the Minister complained of the ‘virtually monopolistic’ role of Azerbaijan in Georgia’s resource imports, and the fact that Azerbaijan does not possess the resources to increase and enhance infrastructures in the country. Looks like here we see more of a political gesture, neglecting the energy security basics.

At the same time Denmark[viii] is considering amending new legislation that theoretically would allow it to ban the Nord Stream 2 project from implementation.

On the other hand, the Russian giant signed a few contracts this week too: Belarus has settled[ix] its $726million debt for gas supplied by Gazprom in 2016-17. Gazprom chairman Alexey Miller and Belarus’s deputy Prime Minister, Vladimir Semashko, have also signed a new deal on gas prices for 2018-19 with a new price formula linked to the price of gas in the Yamal-Nenets Autonomous Area. While on April 11 Gazprom and Slovak Eustream signed[x] contracts securing transit until 2050 with a price tag of €5.3 billion

TOPIC 3: ASIA PACIFIC

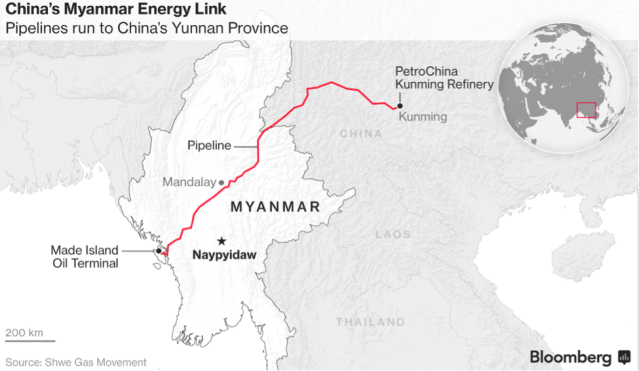

China-Myanmar Energy Link

A crude pipeline linking Myanmar’s West Coast Made Island oil terminal with a refinery in Yunnan province in China began operations.[xi] The pipeline was originally built in 2014, but transit price negotiations resulted in this delay. Its operational capacity is 22 million tons of oil annually (≈442 000 barrels crude a day) and almost 800 km in length. It helps the Middle East oil to get to China faster and via a safer route, avoiding the Malacca Straits and the South China Sea. Out of the 22 mt/y capacity 2 are intended for Myanmar domestic use, though the demand is not yet there, but given the high tempo of its economic growth, they may certainly need it in the future. The destination point of the pipeline is a newly built refinery in the city of Kunming with the capacity of 13 mt/y (261 000 barrels a day), which will supply the nearby regions with petroleum products from now on. Petrochina owns both the pipeline and the refinery. As a part of a bigger picture it signals not only China’s aims to diversify supplies but its ever-growing import of crude and simultaneously growing export of refined products, which potentially may change the balance of power in the market.

LNG

As part of a Russian goal to increase its market share in LNG, Russian subsidiary Gazprom Marketing and Trading Singapore discussed[xii] the 2012 contract with the Indian company GAIL to supply 2.6 million tons LNG per year from early 2018. The physical supply could be from different sources, among them Yamal LNG or Sakhalin.

LNG bunkering becomes a recurring topic among industry professionals, as many hope it will become a important new development in transportation. The first LNG truck loading facility[xiii] has been completed in Singapore. It was created by a joint operation sustained by both the Singapore LNG Corporation and the Maritime and Port Authority of Singapore. It is strategically located within the SLNG Terminal on Jurong Island, and it will facilitate the truck to ship LNG bunkering. Bunkering and storage facilities are of fundamental importance in be the leading bunkering hub in area and -possibly- in the world.

TOPIC 5: USA

Rosneft can soon get[xiv] control over CITGO, a Houston based oil company with 48 petroleum product terminals in 20 states, if Venezuelan PDVSA fails to repay its debt to it. US senators are alarmed, but the public opinion is focused on the US Environmental Protection Agency (EPA) boss Scott Pruitt, who has said[xv] that the US should withdraw from the Paris climate agreement. This is merely a continuation of Trump’s rhetoric, so one should take this critically. Even Big Oil are supporting the idea to stick with COP21.

[i] Sandra Maler : Most oil producers want extension of output cuts: Iran minister. Reuters. April 15, 2017. http://www.reuters.com/article/us-oil-opec-iran-idUSKBN17H0NF

[ii] Golnar Motevalli and Ladane Nasseri: Hassan Rouhani faces tough re-election race as candidate list closes. April 14, 2017, Bloomberg https://www.bloomberg.com/news/articles/2017-04-14/rouhani-enters-iran-election-race-focused-on-his-economic-record

[iii] Saeed Kamali Dehghan: Hassan Rouhani faces tough re-election race as candidate list closes. 16 April, 2017, The Guardian. https://www.theguardian.com/world/2017/apr/16/iran-hassan-rouhani-face-tough-re-election-race-as-candidate-list-closes

[iv] Anjili Raval and Ed Crooks: Saudi Aramco chief warns of looming oil shortage April 14, 3017 Financial Times. http://www.ft.com/content/ed1e8102-212f-11e7-b7d3-163f5a7f229c

[v] Fattouh B., Harris L., 2017. The IPO of Saudi Aramco: Some Fundamental Questions. https://www.oxfordenergy.org/publications/ipo-saudi-aramco-fundamental-questions/

[vi] Rajiv Ravindran Pillai: Jordan’s MGH and GE to build power plant in Iraq. April 16, 2017. http://www.constructionweekonline.com/article-43972-jordans-mgh-and-ge-to-build-power-plant-in-iraq/

[vii] Eurasianet: Georgia Is Giving Up On Gazprom, April 14, 2017 http://oilprice.com/Energy/Natural-Gas/Georgia-Is-Giving-Up-On-Gazprom.html

[viii] Euractiv: Denmark seeks to change law on pipelines amid Nord Stream 2 divisions. April10, 2017 http://www.euractiv.com/section/energy/news/denmark-seeks-to-change-law-on-pipelines-amid-nordstream-2-divisions/

[ix] Energy Voice: Belarus settles gas debt with Gazprom. April 14.2017. https://www.energyvoice.com/oilandgas/136588/belarus-settles-gas-debt-gazprom/

[x] Spectator: Gazprom and Eustream sign deal on gas transports. April 12, 2017. Spectator. https://spectator.sme.sk/c/20507556/gazprom-and-eustream-sign-deal-on-gas-transports.html

[xi] Ting Shi, Jing Yang: China Opens Delayed Myanmar Oil Pipeline to Get Mideast Crude Faster April 11, 2017, Bloomberg, https://www.bloomberg.com/news/articles/2017-04-11/china-opens-delayed-myanmar-oil-link-to-get-mideast-crude-faster

[xii] Sergey Averin: Postavki 2.5mt SPG Gazproma v Indiyu nachnutsya v 2018 gody (Поставки 2.5 млн тонн СПГ “Газпрома” в Индию начнутся в 2018 году). April 12 2017. Ria Novosti. https://ria.ru/economy/20170412/1492073725.html

[xiii] Surabi Sahu: Singapore’s first LNG truck loading facility ready for operations. 13 Apr 2017 , Platts, http://www.platts.com/latest-news/natural-gas/singapore/singapores-first-lng-truck-loading-facility-ready-27813956

[xiv] Sharkov: U.S. OIL COMPANY COULD FALL TO RUSSIA AS VENEZUELA STRUGGLES TO PAY ITS BILLS April 11, 2017, Newsweek. http://www.newsweek.com/russia-may-gain-venezuelan-shares-us-oil-company-582423

[xv] ClimateChangeNews: EPA boss: US should exit Paris climate agreement. April 12, 2017. http://www.climatechangenews.com/2017/04/13/epa-boss-us-exit-paris-climate-agreement/