by Daniel Tsvetanov Photo by Jerry Mathes II

Gazprom plans to expand its presence on the European gas market with the realization of the Nord Stream 2 pipeline, aiming to deliver 55 billion cubic meters of Russian natural gas per year across the Baltic Sea to Germany, bypassing Ukraine. This project became a top priority for the Russian gas company after the dispute between Moscow and Kiev in 2014 and the subsequent cancellation of another major pipeline project – South Stream.

Tensions between the EU and Russia have changed the dynamics of the European energy market, causing further politicization of Russian gas supplies and raising questions whether Gazprom is a reliable supplier. Moscow sees the cause of the insecurities in the gas transit states, such as Ukraine, and proposes Nord Stream 2 as a solution and guarantee for secure and stable supplies for the EU’s gas demands.

The realization of this project would have a direct impact on the role of the current transit states for Russian gas to Central Europe. Poland, Ukraine and Belarus will likely lose their status as transit countries and most certainly will lose vast amounts of revenue. The EU does not speak in one voice regarding the project and opinions vary from state to state. Poland is one of the major opponents and is trying to convince the European Commission to reject the project. Still there is no definitive answer from Brussels and time is not on the side of Gazprom, given the fact that the transit contracts for gas deliveries between Russia and Ukraine are expiring in 2019.

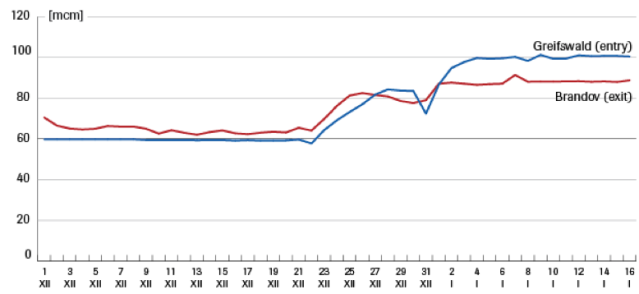

Gazprom has found a temporary solution, appealing to the EU Commission for the permission to deliver more gas through the OPAL gas pipeline situated in Germany (Figure 1), which delivers gas across Germany and to the Czech Republic. In October, the EU Commission lifted a cap on Gazprom’s use of the OPAL pipeline, which carries gas from Germany to the Czech Republic. According to the European Network of Transmission System Operators for Gas (ENTSOG), Gazprom has significantly increased gas transmission via Nord Stream since 22 December, supplying 165.2 mcm of gas per day. Almost all additional gas volumes passed through the OPAL pipeline, increasing the flow from 50% to over 80% of its capacity and hitting record levels of usage. Meanwhile, the volume of transmission through Ukraine has fallen dramatically from 160 mcm to 117 mcm per day (Figure 2).

Figure 1. OPAL and other natural gas pipelines. Source: CEEP

Figure 2. The use of the OPAL gas pipeline (physical flows at the Greifswald entry point, and the exit point in Brandov) in December 2016 and January 2017. Source: CEEP

The increase in gas flows via the OPAL and Nord Stream pipelines has had a direct impact on the amounts of gas transmission via other routes in Central & Eastern Europe and the role of transit states such as Poland. The OPAL pipeline decision, as well as Gazprom’s plan to build a Nord Stream 2 pipeline, embodies the worst fears of the Polish government. In December, the Polish state-run gas company, PGNiG, sued the EU Commission over the decision. The Polish Energy ministry told Reuters that the OPAL increase undermines the security of gas supplies and undermines competition on the EU gas markets and that Gazprom’s plans threaten Poland’s importance as a transit site and potentially undercuts its influence in future gas supply talks.

Gas deliveries from Russia to Germany via the Opal pipeline fell by around 30 percent after Poland successfully appealed before the European Court of Justice (Figure 3).

Figure 3. Transmission volumes through OPAL and Ukrainian GTS, mcm. Source: Gas News Today

Poland has been critical of Russia’s plan to bypass Ukraine, challenging Gazprom’s Nord Stream 2 project from the beginning. Poland’s competition regulator expressed concerns over the creation of a joint venture comprising Gazprom and its five European partners, rejecting Gazprom’s and its European partners application for merger approval.

Poland imports most of the 15 bcm of gas it consumes from Gazprom, but the long-term agreement on gas supplies with Gazprom terminates in 2022. The polish government has already proposed a project which would ship gas from the Norwegian continental shelf to Poland via Denmark to substitute Russian gas. It would consist of a new pipeline between Denmark and Poland, known as the Baltic Pipe, and an infrastructure upgrade between Denmark and Norway. The Polish strategy is to diversify imports, while maintaining its status as a transit country and keeping the revenues from gas transit from Russia to Central Europe.

Still there is no final decision from Brussels for Gazprom’s projects and the results of the Polish challenges remain uncertain.

Daniel Tsvetanov is a student at ENERPO Program, European University at Saint Petersburg. He can be contacted via email dtsvetanov@eu.spb.ru